Buying an Apartment in Italy: Our First Mistakes

- Kiki Teague

- Sep 19, 2024

- 4 min read

There are lots of challenges to buying property in a different country and you're going to mess something up, trust me. Here are the first three things we learned the hard way so you don't have to.

Mistake #1 buying an apartment in Italy - Codice Fiscale

What is this and how do you say it?

The Codice Fiscale (Co-dee-chay Fis-cal-ay) is the number used to keep track of you in the Italian tax system, it has 16-alphanumeric characters and you MUST have it to sign a lease or open a bank account or buy property. You don't need to be a resident or a citizen to get, it but you gotta get it.

It's a relatively simple process while you're in Italy. The Italian government wants you to have it, it's how they make sure they can collect taxes from you. But as with all things government related, it can be complicated.

The easiest thing to do as a non-EU resident is to go to the Italian Revenue Agency and fill out the form (which will probably be in Italian so have Google translate ready) for a Codice Fiscale. Then you give them your passport and they generate the code for you and give you a piece of paper with your number on it. That's it. That's how it's supposed to work...when you're in the country.

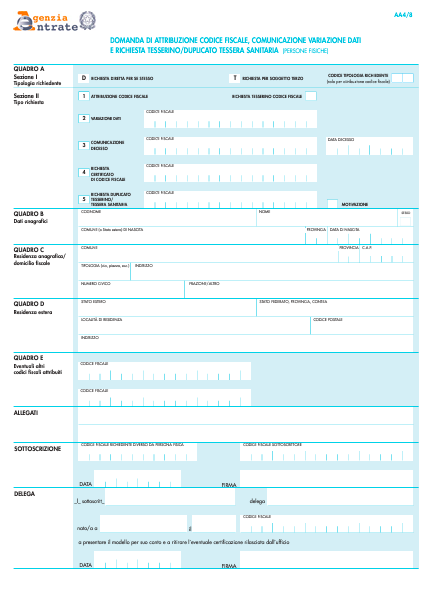

Here is what the form looks like. Even after using Google Translate I couldn't figure it out. I then Googled "how to fill out a Codice Fiscale in English" and followed their steps one at a time.

We found the apartment we wanted to buy the day before we left Italy and made the offer a few days after we got back to the USA. To make the offer official the listing agent asked for our Codice Fiscale. When we said what's that and how do we get it? His reply was, just go to the tax office, they will give it to you.

Us: The tax office in Turin?

Him: Yes.

Us: But we're in the US.

Him: No problem, come to Turin or even Milan and get it.

Yeah, no. This revealed our second mistake. Before you jump into real estate purchases in a new country hire help. It's worth it! Hire someone who speaks the language and knows the system and can walk you through it. In our case I found a woman who was a real estate agent in America, has lived in Turin for over 15 years, speaks Italian and knows how to get things done. More on that later.

So our interpreter made it clear to the agent that flying us all they way back to Italy was out of the question and asked why didn't he tell us we could contact our local embassy and apply for the Codice Fiscale? He said it's not his job to hold our hands. Cool.

Not to worry, our "hand-holder" told us, make an appointment at your closest Italian Consulate. They can do it right there. Sounds simple, right?

Sorry, I had to take a break to laugh hysterically but I'm back now.

In the USA we are close to the Italian Consulate in Philadelphia. My American mind says the process should be the same here as in Italy. Go to the office, give them your info, receive number. NOPE!

The Italian Consulate in Philly does not allow visitors without an appointment. When you call to make an appointment they don't answer the phone, when you leave a message they don't call back. During the three weeks we were in the US we never spoke to a single person at the Consulate.

So, we head back to Costa Rica and start over. There's an Italian Consulate in San Jose. We send an email declaring our ignorance and our mistake and throw ourselves at their feet begging for help and mercy. Miracle of miracles they respond promptly and say the entire process can happen online if we send them our info and fill out the form.

That's exactly what we did and precisely what they did. Within a week we had our Codice Fiscale and our purchase was back on track.

Mistake #2 - Paying the Listing Agent First

We have purchased three properties in Costa Rica. There are differences, of course, from buying properties in the US but for the most part, it was very similar. We had one agent we worked with (he was from Canada so he had a good understanding of what we needed to know to buy the condos and speaking the same language was a huge help). The whole process went a lot like buying in America.

In Italy, the only agent you're dealing with is the listing agent. When he sent us the bill for the deposit to secure the property, he included his payment upfront. After our money went to Italy, we noticed a distinct dropoff in the already marginal customer service we were getting from the agent.

Which is when we found our translator/real estate agent/Italy "hand-holder" Natalie. Because, seriously, the guy pretty much quit communicating with us. We had to schedule inspections and who knows what else and we needed boots on the ground.

Turns out that we weren't supposed to pay the agency before the closing. If something had gone wrong with the sale it would have taken a long time to get that money back.

Mistake #3 - Not hiring a translator first

This is the biggest mistake we've made so far. We could have saved time and money and stress if we'd searched for someone with experience to help us before we looked at places and definitely before we left the country. You might think it's an unnecessary expense, it's not! Unless you speak the language fluently and know the culture and customs you're going to get lost in the runaround.

Summing it up

You will make mistakes when buying a home in another country. You can do tons of research and still make mistakes. This is part of the adventure so don't beat yourself up. If you'd like to know more about Turin go to our Italian Adventures page, I'll also add a link to Natalie's business if you're shopping for a home or looking to rent in Turin.

Send me your questions and I'll see what I can do to help!

Arrivaderci!

Comments